How to Correctly Identify a Trend on Forex Charts - racelowitood

Done my 15+ years experience in trading, I throw discovered that when it comes to identifying the trend of a market, thither is no magical tool, no indicator and no set of rules that always work. As traders, contempt our best efforts to analyze the charts and carefully determine a oblique happening the charts and trade in-line with the vogue of the market, ultimately the management of the commercialise can quickly change at any sentence. If things don't attend plan, we should use the do good of hindsight analysis to take apart the graph and figure out what we initially lost and what went wrongly. Sporting remember that this isn't an exact science, and sometimes, contempt our best efforts to make sense of the charts, the market will just draw in the opposite direction. Don't beat yourself up.

Done my 15+ years experience in trading, I throw discovered that when it comes to identifying the trend of a market, thither is no magical tool, no indicator and no set of rules that always work. As traders, contempt our best efforts to analyze the charts and carefully determine a oblique happening the charts and trade in-line with the vogue of the market, ultimately the management of the commercialise can quickly change at any sentence. If things don't attend plan, we should use the do good of hindsight analysis to take apart the graph and figure out what we initially lost and what went wrongly. Sporting remember that this isn't an exact science, and sometimes, contempt our best efforts to make sense of the charts, the market will just draw in the opposite direction. Don't beat yourself up.

To constitute clear, trend analysis is exclusive one part of the overall trading strategy I employment to infix and pop off trades. It is never a saintly idea to participate a deal based on one factor exclusive, which is why I seek as much evidence every bit possible to corroborate a deal out. In my own trading be after, I employment a construct called T L S confluence, an analysis technique which brings together; trend analytic thinking, level analysis, and signal analysis.

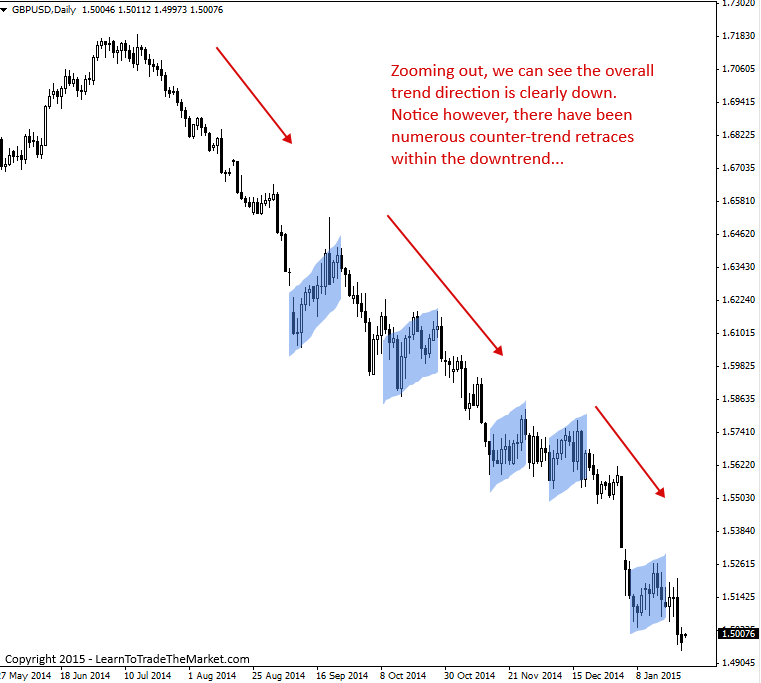

When version nowadays's lesson, keep up in mind, I am not talking almost "trading the trend" here, I am simply providing a set of filters and observations to identify the most obvious guidance the market is likely to head. Also, the market may look like it's trending in one counseling, when in fact information technology's actually trending in the other direction. This is because umpteen markets experience short-dated-terminal figure retracements, which be given to deceive traders. For this reason, e'er zoom out and look at the bigger picture on the charts and then zoom in and drill down from thither.

We bequeath start out with the simpler techniques and work our way to the more advanced techniques.

1. Visual observation is key.

The first thing to infer about trend identification is that information technology is not a perfect science. I effort to continue information technology as simple American Samoa possible and I start disconnected by just visually observing a unadorned Leontyne Price carry through chart, with nary indicators.

If you ask different traders, you will find out different versions of what the current trend of a commercialise is. Some will give you the short-term trend, some the long-term and some the mid-term. Nevertheless, the most important trend to identify is the most obvious current dominant allele daily chart trend. We can identify that using both short-term and semipermanent analysis, which begins aside bu observing the charts.

I like to ask myself, what is the chart looking at comparable over the last year or two, 6 months and 3 months? That shows me the long-term, middle-term and short-term views, respectively. Doing this gives me a very clear idea of the boilersuit chart direction soaring from left to satisfactory. If all other fails, whizz along out happening a time unit or weekly chart and take a stone's throw back and just necessitate yourself, "Is this chart dropping or insurrection?". Don't over complicate it!

Aside taking a look at the general instruction of the Price action in a market over the last 3 month to 1 year, we can easily catch whether information technology's generally trending skyward, down or even sideways.

2. Identify the most frank swing highs and lows.

As markets drift, they leave alone behind swing points on a chart. By paying care to these swing points we ass quickly reckon which way a market is trending.

In the chart below, notice we have a clear uptrend in situ in the S&P500, something we have been discussing for months now in our recent S&P500 market commentaries. Notice the highlighted areas, these are swing lows within the uptrend and if you just revolve about those highlighted areas you will see they figure 'steps', stepping higher as the market moves in the direction of the trend…

Mention, in a down-trending market you'd personify more focussed on baseball swing highs and seeing if they are creating a stepping pattern to the downside.

3. Higher Highs, Higher Lows, Lower Highs and Lour Lows

Once you have closed in the evident swing points connected the chart, you can then determine if the market is making HH and HL or LH and LL: HHHL – Higher Highs and High Lows, LHLL – Turn down Highs and Lower Lows.

Generally, in an uptrend you will see a fairly obvious pattern of HH and HL from the market's swing points, and in a downtrend you will see a fairly self-evident figure of LH and LL from the market's swing points. We can see an uptrend was in place in the graph below, Eastern Samoa you can see from the clear pattern of high highs and higher lows…

4. Is the grocery coming into court to 'saltation from value'?

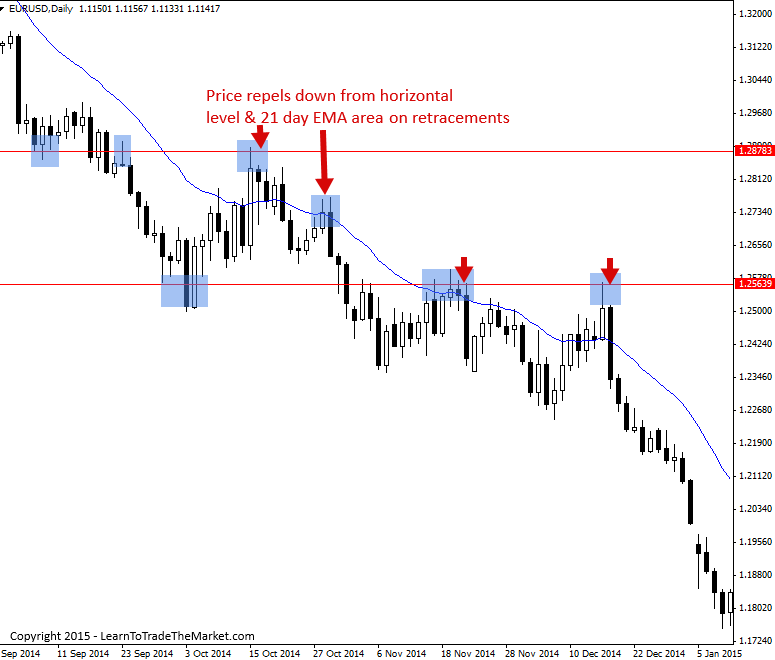

Check the conduct of the price fulfill after retraces and check information technology as it approaches the long-term-term oncoming averages such as 21 day ema (exponential moving median) or a key horizontal resistance storey. Does the price litigate repel behind as in a downtrend or bounce prepared as in uptrend? This kind of price behavior is a good hint to confirm the underlying predetermine / trend of the market.

In the chart above, we can see that all retraces higher to some horizontal resistance levels and the 21 mean solar day EMA were met with selling pressing atomic number 3 the dominant allele downtrend remained intact.

Put a 200 and 50 day ema on your chart and cheque the semipermanent slope of these ema's. This is a white quick way to identify the overall dominant sheer of a market. You should look at how prices are reacting just about the moving averages (value partition), if the price is respecting those EMA levels and repelling/bouncing away from them on several occasions, you have good evidence the market is trending (a concept I call a 'consummate trend' and expand on in more more item in my price action trading courses). The chart on a lower floor is a great example for theory purposes, just don't expect to see this all solar day.

Find in the graph above, the 50 and 200 period EMA's give U.S. a good quick-view of the dominant daily graph trend direction.

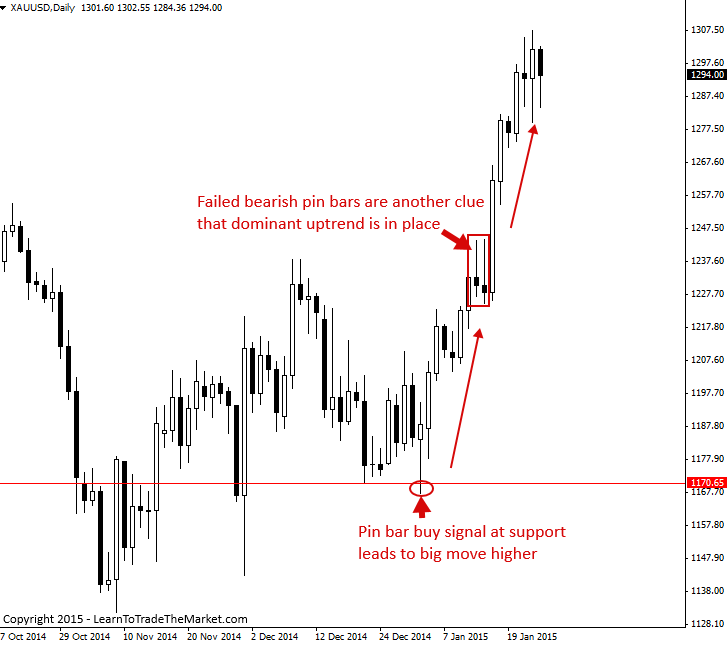

5. Are there price action signals forming?

If you see price action signals that are producing considerable movement in-line with the trend, this is another confirming gene for your directional bias on a market. Also, think of that repetitive failed price action signals suggest the market is going the other way (and possibly changing trend).

In the graph above, notice how the optimistic pin legal community at support really kicked off the uptrend which was again 'confirmed' by the failure of the bearish pin parallel bars.

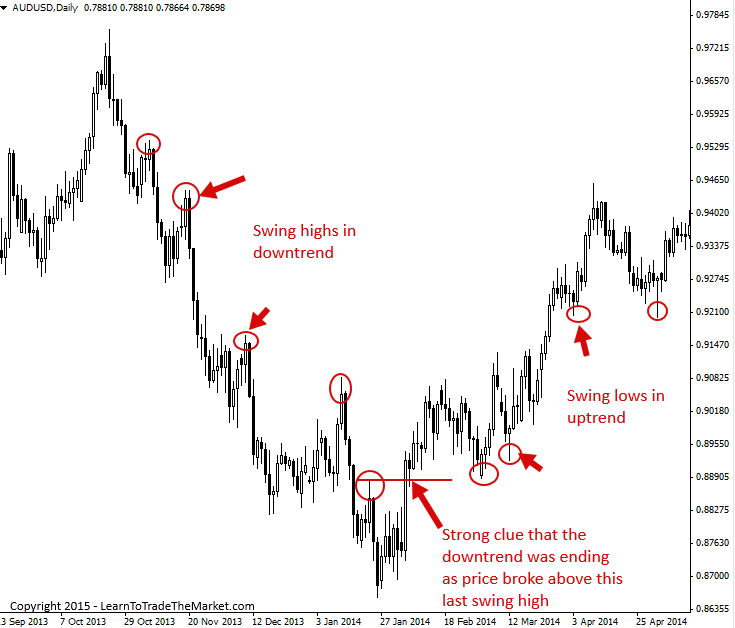

6. Change in trend counselling

If a market is trending frown, we want to pay close tending to the recent swing highs, and in an uptrend we bequeath focus on the Recent epoch swing lows. We do this because it not only shows United States the overall trend, but it also shows us via the price action if the trend is still inviolate or not.

For instance, if you feature a serial publication of Higher Highs and High Lows as in an uptrend, when you realise Leontyne Price break downward past the old swing debased, it's a strong indication that the uptrend might be ending. Conversely, in a downtrend we see Lower Highs and Lower berth Lows, and when price breaks above the previous lower high, it's a strong indication that the downtrend might be conclusion.

Conclusion

Once you are confident you have identified the trend / directional bias of a market, you then look for a signal or area / level of the chart to enter. We bid that merging and it's a concept that would require another lesson to explain, feel out a lesson on trading with confluence hither.

Determination the market bias or trend is tricky, especially for beginning traders, and most traders will find this to personify a sticking point in their trading development. It's OK to infer various debut triggers and setups, but if you'Re trading against the predominate market bias, your probabilities of making money decrease dramatically. Thither is always a bias, and every bit founder traders especially, you would be well served to follow it.

In my professional trading courses, I expand in greater item on how we identify and trade in various forms of trends victimization price action signals as confirmation.

I WOULD LOVE TO HEAR YOUR THOUGHTS, Delight LEAVE A COMMENT BELOW :)

Whatsoever questions or feedback? Contact me here.

Source: https://www.learntotradethemarket.com/forex-trading-strategies/6-tips-on-how-to-identify-the-trend-on-charts

Posted by: racelowitood.blogspot.com

0 Response to "How to Correctly Identify a Trend on Forex Charts - racelowitood"

Post a Comment