What Does Units Mean In Forex

Lot in Forex or on the exchange is a unit of mensurate for position volume, a fixed amount of the base currency in the Forex market. The book is e'er indicated in lots, and the size of lots directly affects the level of risk. The greater the volume of i lot in Forex, the greater the risk. Gamble assessment (gamble management) includes a model that allows you lot to calculate the optimal corporeality of standard lot in the foreign exchange markets based on the estimated risk level, volatility (terminate loss level), and leverage. Read the article to find out most this model, how to use it, and how a trader's estimator can assist.

The article covers the post-obit subjects:

- What is a lot in forex?

- What lot size to use in forex: building an optimal take a chance direction system

- How to calculate lot size in Forex

- Maximum lot size in Forex

- What lot size to use in forex: building an optimal risk management organisation

- What determines the lot size in Forex

- How does equity change depending on the lot size

- How to set the lot size in MT4

- What is a lot in other markets?

- Conclusion

- FAQ

What is a lot in forex?

In the usual sense, a lot is a standard unit of measurement for measuring the volume of a currency position opened by a trader. That is the amount of money invested in the purchase of a currency in club to sell at a higher toll afterward. Lot calculation is an element of the take a chance direction arrangement. It is essential to know what is lot size to build a balanced trading system.

How much is 1 Lot?

In forex, you tin can but open up positions in certain volumes of trading units called lots. A trader cannot buy, for example, i,000 euros exactly; they tin can buy 1 lot, 2 lots, or 0.01 lots, etc. According to the lot size definition, lot is a term used to define the contract size for a trading asset. It is the transaction size, the volume of the trading nugget (currency, barrels of oil, so on), which a trader could buy or sell.

-

Instance. 1 barrel of oil is 40 USD. When a trader sets a buy or sell order, he/she does not specify the number of barrels; the trade is divers in the number of lots. Lot is a contract size consisting of a fixed number of barrels, written in the contract specification. The size of the contract for each broker tin can be different. One broker offers a lot of x barrels; some other broker has a lot size of 100 barrels. In both cases, the transaction is made in the volume of ane lot. In the first case, the merchandise means 10 barrels; in the 2d case – 100 barrels.

What lot size to employ in forex: edifice an optimal run a risk management arrangement

Allow us detect out what one lot in forex is.

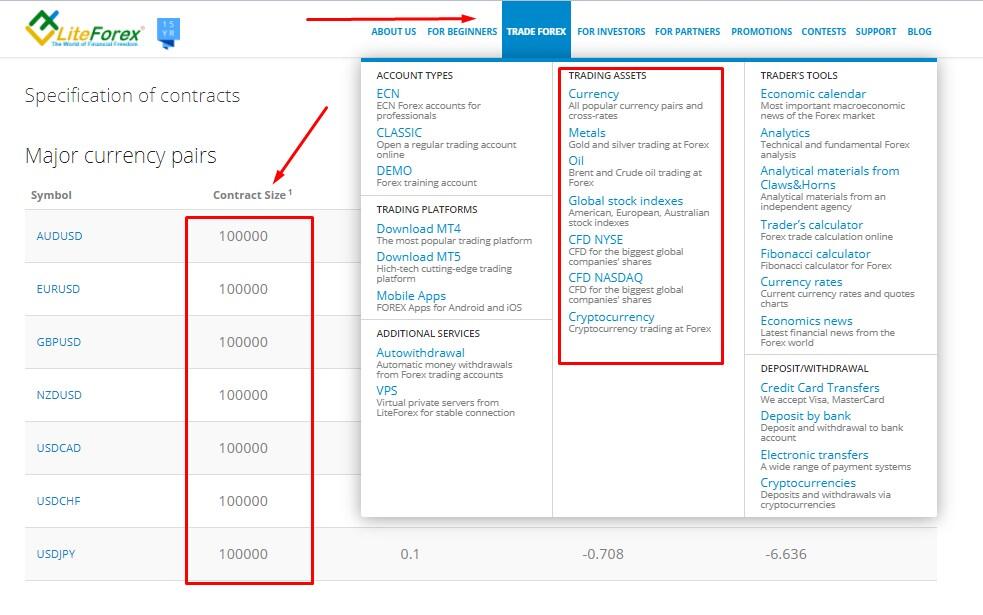

The standard lot in Forex is 100,000 units of base currency. For example, if the EURUSD rate is ane.1845, you volition demand 118,450 base currency units to open the position of 1 lot. Information technology means y'all will need 118,450 US dollars to buy 100,000 euros.

The base of operations currency is the currency that is bought or sold for another currency. It always comes commencement in the quote. For instance:

- 0.01 lot of the GBPUSD with a quote of 1.29412 means that you lot will pay 1 294.12 USD to buy 1 000 GBP.

- 0.01 lot of the EURAUD with the quote of 1.65981 ways that yous will pay 1 659.81 AUD to purchase thousand EUR

The value of 1 standard lot of 100,000 units of the base currency is relevant for currencies. Other assets have a different lot size meaning. For case, for stocks, this is the number of stocks. The number of stocks in a lot depends on what stock is meant. Oil is measured in barrels, gold - in troy ounces. You lot can encounter the lot value, the number of conventional units of an nugget in i contract, in the specification.

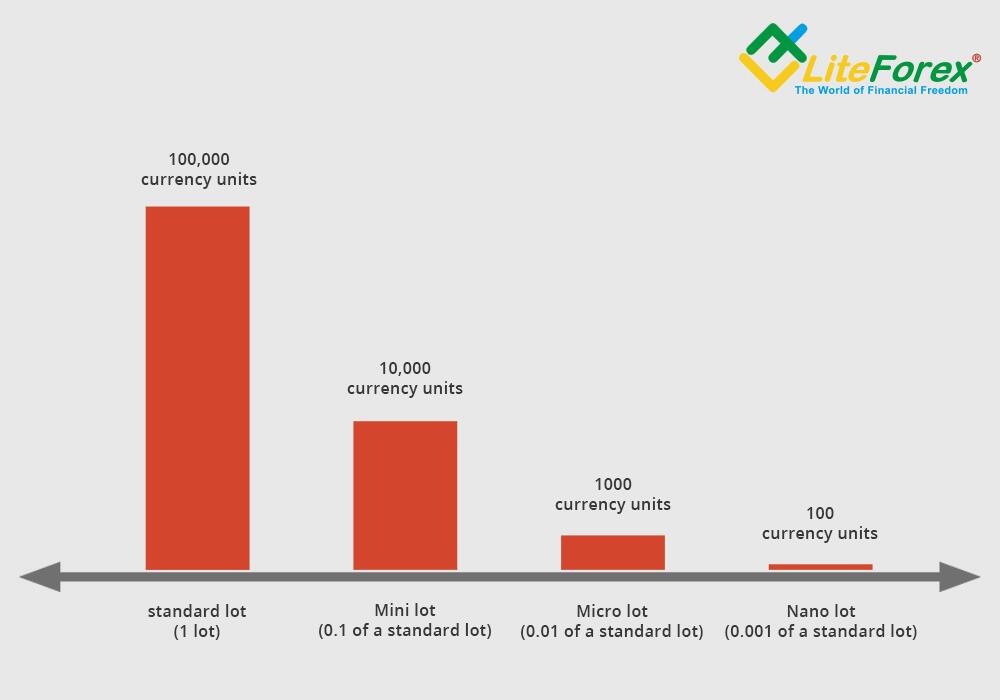

- A mini lot (it can be also written as minilot to mini lot) is 0.1 of a standard lot or 10,000 units of base currency.

- A micro lot (it tin can also be written as microlot or micro-lot) is 0.01 of a standard lot or 1000 units of the base currency.

- A nano lot (information technology can likewise be written as nanolot to nano-lot) is 0.001 of standard lot or 100 base of operations currency units. (Yous tin rarely come across a nano lot in the brokers' trading conditions)

Most traders set minimum and maximum lot volume for unlike types of accounts. The top limit is often at 100 lots; the bottom boundary is 0.01 lots. If we take the example above, the minimum investment will be $ 1.184. If you use the leverage i:100, and then a minimum deposit of $11.84 will exist plenty to commencement.

Nonetheless, information technology will be relevant provided that 100% of the money (which is unacceptable from the point of view of gamble direction) will be invested in the position. At that place is a 2nd pick - to use cent accounts (if the broker offers cent accounts). The only difference of cent accounts is that the calculations are in cents, not in dollars, so $11.84, in this case, is enough to buy the minimum micro lot without using leverage.

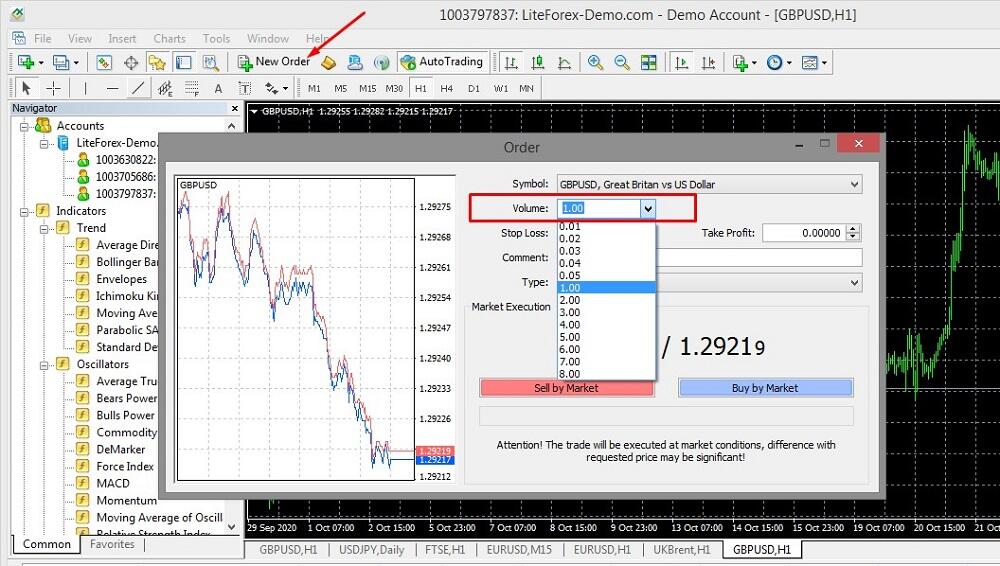

This screenshot displays an society being opened in the trading terminal. You tin can select the different forex lot sizes in the tab "Volume of a trade in lots." The position size can be increased only step by step. The account specification determines the step size. For example, the minimum stride size on the Classic account is 0.01 lots. The trader can manually enter the position volume accurate to the hundredth of a lot, for case, 0.06; 0.07 or i.23 lots, so on.

Important: Despite the standard terms, some brokers can utilise them differently. For example, ane of the brokers has one lot equal to 10,000 base of operations currency units. Mayhap this is intended to reduce the minimum corporeality of deposit without leverage. In any case, earlier y'all first to merchandise, advisedly read the offer, account details, and contracts specification.

Mini Lot size

A mini lot is ten% of a standard lot. When y'all open up a 1-lot merchandise on a mini lot forex account, you buy or sell ten,000 units of the base of operations currency instead of 100,000 as with a standard lot. The mini-lot is convenient as information technology requires less money to enter a merchandise, and then yous need a smaller eolith.

Micro Lot size

I will demonstrate a micro lot forex using an example.

The trading nugget is the EURUSD pair; the exchange rate is i.1826. One standard lot is 100,000 of base currency. If you want to enter a merchandise of ane lot, you should spend 118,260 USD to buy 100,000 euros. If you are an individual trader, y'all are unlikely to have such capital at your gratis disposal. The minimum lot size forex under trading weather condition is 0.01. Merely even in this case, y'all need to invest $1,182.60. Risk direction rules signal an acceptable take a chance per trade of ii% of the deposit corporeality. This means you need 1,182.lx * 50 = 59,130 USD for one minimum trade of 0.01 lot.

A micro lot is 1% of a standard lot. When you enter a EURUSD trade of 1 lot, you purchase thousand euros for 1 182.threescore US dollars. A trade of 0.01 means you lot buy ten euros for 11.83 dollars.

Nano Lot size

A nano lot is 0.ane% of a standard lot. Nano-lot accounts are chosen cent accounts. One lot here corresponds to a trade for 100 units of the base of operations currency. If nosotros take the example from the previous section, a merchandise of 1 lot ways buying/selling 100 EUR for 118.26 USD. The smallest possible transaction with a volume of 0.01 lot ways buying 1 euro for one.1826 The states dollars

Regular accounts do not allow to make transactions for such small volumes. All the same, cent accounts take a drawback. Not only the transaction volume, i.east., investment, is 1000 times less, but also your potential profit is chiliad times less. So, professional traders, who want to recoup the time spent and brand existent profit, do non use cent accounts.

Why could y'all use cent accounts?

- To proceeds experience. The quotes on demo accounts are ofttimes different from existent accounts. A Demat account is a kind of simulator, while the nano account is real trading in existent market weather. That is why beginner traders, moving on from demo accounts, outset from cent accounts.

- To develop and upgrade strategies, test Good Advisors on a real account. Forward testing will not give full confidence in the trading system's performance in the real marketplace. If the trading strategy is profitable on a cent account, it will work on a regular account as well.

- To test new trading tools, scripts, indicators, and so on.

- To train emotional stability. It is more stressful to lose existent money than to trade with virtual money.

Using Standard Lots

A standard lot size is the maximum possible contract size provided by the broker's trading conditions. Practice not confuse the maximum lot with the standard 1:

- A standard lot, a mini lot, a micro lot – all these concepts define the number of asset units in one contract. For example, a standard lot is ten barrels of oil or 100,000 euros in the EURUSD currency pair. A mini lot is correspondingly one barrel of oil or 10,000 euros.

- A maximum lot is the maximum possible number of lots for a transaction. For example, v standard lots are 5 * 10 = 50 barrels of oil, v mini lots is 5 * i = 5 barrels of oil.

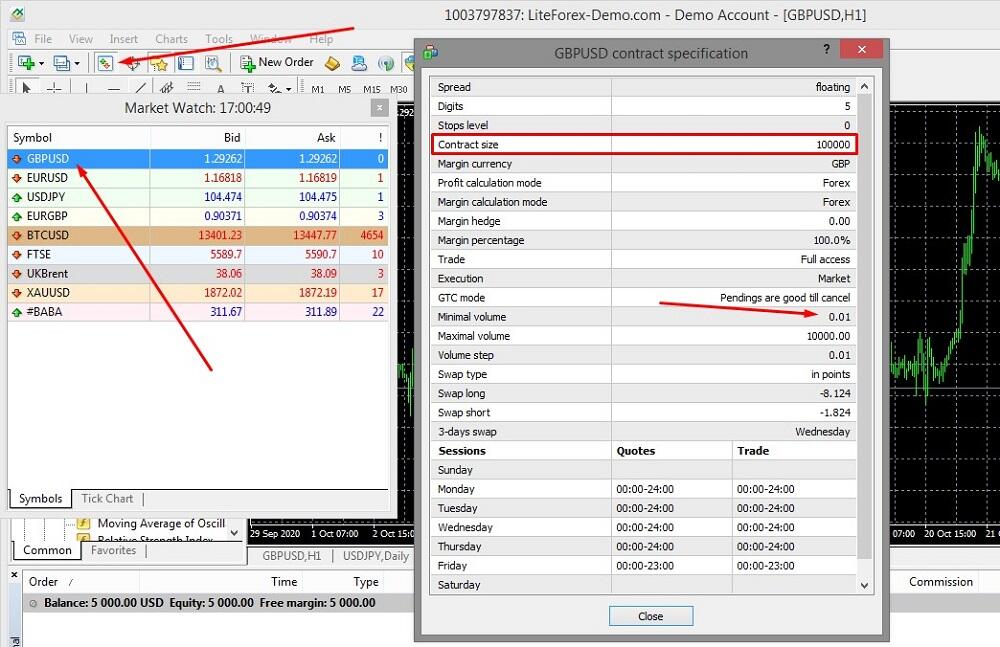

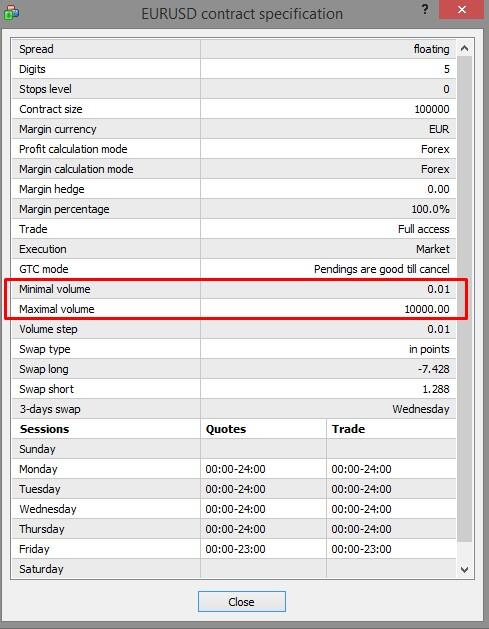

Y'all can find the information about the lot type used on a trading account in the MT4 contract specialization. In the Marketplace Sentry tab, right-click on the asset (currency pair) and select the Specification tab.

It is clear from the specification that the contract size is 100,000, so the lot is standard. The specification as well reads that you tin can enter a trade of a minimum volume of 0.01 lot or the maximum book of x,000 lots. In MT4, the trade book tin be selected in the window of the position opening:

The minimum transaction book for the GBPUSD pair is 0.01; the maximum is following the specification. The volume is not limited to 8 lots, equally in the screenshot - you can enter any number up to x,000 in 0.01 increment. For example, 10.02, 10.03, etc.

I will give an case to explain how the merchandise volume affects the deposit amount, margin, and profit/loss. To compare, I will open in the LiteFinance terminal two demo accounts with a deposit of 2,000 USD each, with a ane: 100 leverage. I will open positions with a volume of ane and 0.ane lots.

I commencement open up a merchandise of i lot:

Out of 2000, the broker immediately blocks $ i,174.47 as collateral, and a floating loss of -eleven.00 USD appears. In that location will not exist enough money to open a second club with the same amount of money.

Now I open a position of 0.1 standard lot:

Of the 2000 USD, only 117.46 is reserved as collateral. I can employ the remaining cash residual of 1880.64 to open new positions for the aforementioned or other assets. If you lot reduce the lot size, you can open positions, but the financial result likewise decreases. For example, in this case, the floating loss is less, it is -1.50 USD.

Then, the main takeaway is:

- The less is the transaction volume, the more positions you can open up. For example, y'all can enter trades on different assets.

- The less is the transaction, the more free funds you volition have on your business relationship. So, you can stand with a more significant drawdown before the trades are stopped out.

- The less is the transaction, the less is a potential profit/loss.

If you are sure in your trading decision to buy or sell, you tin can open a trade with a higher volume to increase the profit. If you take doubts, you'd better open up a position with a smaller volume to reduce a potential loss. Aggressive strategies with a high risk level advise inbound trades with the maximum possible lot to increase the eolith. Conservative strategies suggest minimization of loss rather than chasing after the high profit, so they imply entering trades with a small volume.

How to calculate lot size in Forex

For whatever asset y'all enter a trade, it will in any instance be made in the account currency. In virtually cases, it is the USD. Therefore, it is crucial for traders to sympathise how much money they will really have reserved in USD when opening a position, for case, for a cantankerous rate. A cross charge per unit is a currency pair that doesn't contain the The states dollar (for instance, when yous merchandise the franc versus the yen).

The easiest way to use the trader reckoner or forex lot calculator to notice out the lot size in Forex:

Why should you lot calculate the lot size:

- To optimize the position volume in relation to the deposit amount, considering the risk and the expected profit. I volition help you develop a balanced trading system.

- To select the correct lot size and the system of the deposit increasing then that the total trading position volition exist resilient to drawdowns, cost corrections, pullbacks, and volatility.

Remember, the leverage size does non affect the risk if there is a conspicuously divers target for the position book. With the same lot size, the alter in leverage affects just the amount of the collateral.

You should also note whether a direct or an indirect quote when calculating the pip value. For example, the pip price in the EURUSD pair is x USD in the Forex standard lot. In the USDJPY pair, the pip cost volition already exist 9 USD. The lot calculation formula will exist is like this: (1 indicate *lot size)/market price.

Next, I will explain examples and formulas for calculating a lot size in USD for different types of assets.

i. Example of lot size calculation in Forex

Lot = contract size * merchandise book * asset cost

- Case 1. The contract size for a stock is one; 1 lot is 1 stock. The stock price is 54 USD. 1 lot is 54 USD.

- Example 2. The contract size for the EURUSD currency pair is 100,000; the price is ane.23456. Lot value = i.23456 * 100,000 = $ 123,456.

2. For directly currency quotes:

Lot = contract size * trade book

- Example. The contract size is 100,000; trade volume is 0.1 lot or 1000 units of base currency. The rate of the USDCHF – 0.91070. Lot value in USD = 100,000 * 0.01 = i,000. This ways that with a trade volume of 0.01 lots, 9,107 CHF will be bought and 1,000 USD reserved by the broker.

3. For cross rates:

Lot = contract size * trade volume * nugget cost / quoted currency cost

- Example. The contract size is 100 000, the trade volume is 0.01 lot or k of the base currency units. The GBPCAD exchange rate is 1.72608, the base currency is (the first in the pair) GBP, the exchange rate of the USDCAD is 1.32972. The lot value is 100 000 * 0.01 * i.76028 / 1.32972 = 1 298.08 USD

How to calculate the pip value?

Depending on what a trading unit is (lot, mini lot, or micro lot), and besides depending on what is meant by it, the price of a pip is adamant. The pip value is the profit or loss that a trader receives in the currency of the deposit when the price passes 1 pip (point) in one direction or another. The pip value is also very easy to recalculate using the trader computer mentioned above.

The pip value for ane full lot (trade of one lot):

- Standard lot: i pip yields a profit of 10 USD.

- Mini lot: 1 pip yields a profit of ane USD.

- Micro lot: 1 pip yields a profit of 10 cents.

- Nano lot: 1 pip yields a profit of 1 cent.

If you lot enter a trade of 0.i lot, the pip value decreases ten times correspondingly. With a standard lot, one pip yields a $1 profit. Differently put, the gain of one pip in a trade of 0.1 standard lot is equal to the profit of i pip in a trade of ane mini lot.

Example of lot size adding on Forex

There are the following input parameters:

- Eolith: 3000 USD.

- Take a chance - v% per merchandise.

- Leverage - 1:100.

- Terminate Loss - l pips.

The position amount volition be 3000 * 100 = $300,000. If we are going to invest 100% of the money in one trade, then the maximum book of the lot will be 2.4 lots given the EURUSD rate at 1.2500. But nosotros are going to stick to the hazard management rules. Allowable risk per trade will be 3000 * 0.05 = $150. Since we can beget a maximum drawdown of 50 points, the maximum allowable price of one point is 150/50 = $3. Let me remind you that for one standard lot, the outlay of one indicate is $10. Hence the maximum permissible lot is 0.3. The minimum lot size is 0.01. Since for 0.3 lots we need $37,500, we invest $375 (12.v% of the eolith, which is in accordance with the gamble management rules) and utilise a leverage of one:100.

Thus, the lot volume depends on the drawdown the trader allows in the calculations. Here, the unproblematic model in Excel volition show the dependence of the lot on the drawdown (or stop loss).

The second calculation method using leverage says that all open positions' maximum risk should exist no more than 15%. 3000 * 0.15 = $450, which with a leverage of 1:100 is $45,000. We split up the position by the current rate (say, 1.2500 for the EURUSD). 45,000/125,000 = 0.36 lots. The result is nigh the same every bit the previous one, simply I don't like this method. Information technology does not have the drawdown into business relationship.

If the trader adheres to the rigid rule "a fixed percentage of the deposit per transaction" and "a stock-still percentage of the deposit for all transactions in the market," then the leverage is non essential. The greater the volume of the lot, the higher the pip value, and the faster the eolith will disappear in case of price reversal.

Managing the volume of open positions includes the post-obit:

- Identifying the optimal ratio of the volume of open trades and take a chance level. High volatility can deplete the eolith speedily; the trader'due south task is to choose the optimal ratio of the open trades' book to the deposit, taking into account the run a risk. In markets with a strong trend, the management of trade volumes should involve the use of lot increment coefficients (an element of the Martingale strategy).

- Evaluation of the viability of the total position in the market. "Should I close unprofitable trades or wait out?" This is a classic Forex problem that you tin can solve past managing the book of trades. The take a chance direction strategy includes a model that would let selecting the optimal resistance and support levels without reaching a stop out by adjusting the position volume and leverage. In other words, in that location is a stop-out level, and there is a strong level where the cost will alter management with a high probability. The model volition allow you to choose the optimal position volume at which the deposit will withstand the drawdown to the main level without reaching stop out.

Maximum lot size in Forex

Regardless of what type of lot is indicated in taccount'due south he trading conditions, there is always its minimum and maximum value. You can find out the maximum lot size in the contract specification in, for example, in MT4.

Case 1.

This is the screenshot of the contract specialization of the EURUSD currency pair. The contract size is 100,000. Information technology ways that the standard lot is used on the account.

The minimum possible trade is 0.01. Information technology means that you tin can only buy a minimum of 1,000 euros, which would crave $ 1,182.4 at the charge per unit of 1.1824.

The maximum lot is 10,000. It means that y'all can buy 100,000 * ten,000 = 1,000,000,000 euros, for which you lot but need ane,182,450,000 USD.

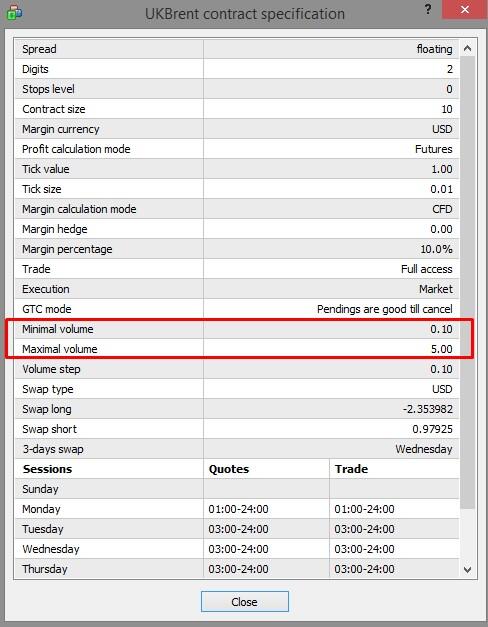

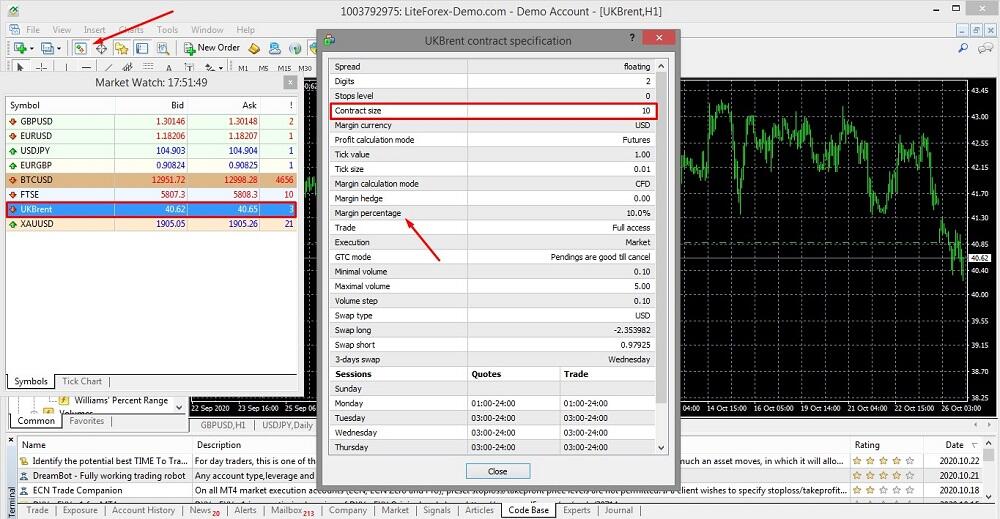

Example ii.

This is the contract specification on the UKBrent, oil contracts. 1 standard lot is 10 barrels, ane butt costs 41.07 USD.

The minimum lot is 0.ane. This means that you can buy at least 1 barrel for $ 41.07. You tin can't enter a trade with a smaller book.

The maximum lot is 5. It means that you can buy 5 * ten = 50 barrels, which will crave 41.07 * 50 = $two,053.fifty.

Important! These calculations do non take into account the employ of leverage and the specified margin percentage. Leverage reduces the required investment amount.

What lot size to employ in forex: building an optimal risk management organization

An optimal adventure management model should answer the post-obit questions:

- What level of risk is the trader willing to have on? What losses are acceptable according to profit targets? The greater is the hazard; the greater is the potential profit. Conversely, the amount of potential loss also increases. Everyone determines the optimal balance for themselves. Alternatively, a combination of conservative and aggressive strategies is possible.

- What book of the transaction must be in club to comply with the rules of the take chances management organization? Adventure management rules are based on mathematical probability and progression. The transaction volume is calculated based on the average and electric current volatility, the amount of the deposit, and the leverage that reduces the amount of the collateral blocked past the banker.

- What is the level of commanded drawdown and at what level should you place your end loss? Based on the book of the position and, accordingly, the value of the point, the trader estimates the level of volatility and determines the stop loss point.

Input parameters for edifice a trading model that bear upon the level of risk are the following: Transaction book in lots and lot type, leverage, pip value, volatility, spread level, risk per transaction, the full gamble level of all open up transactions in relation to the eolith, eolith amount, target profits.

Models for calculating the optimal lot size manually and using a lot value calculator:

Near all trader's calculators accept the same problem: you cannot calculate the lot book with regard to the risk level, although this is precisely the bespeak of planning trading volumes. I suggest that you use the following formula for computing the lot concerning the adventure level:

Lot volume = (% hazard * deposit) / А * (Рrice one - Рice 2)

% take chances is the amount of the eolith that the trader is willing to allocate for the trade (the notorious recommended v%, which I have mentioned above). A is a coefficient equal to 1 for a long position and -1 for a curt position. Price one and Toll two - the opening price and the finish loss level. The end loss level in this case is ane of the options for averaged or maximum volatility, which I besides mentioned above.

What determines the lot size in Forex

The standard lot size in currency pairs is a constant value, 100,000 basic units. The different lot price is the amount of coin that will exist blocked past the broker as collateral. The toll depends on the nugget value. You can enter 2 trades of 1 lot each; the dissimilar sums will be blocked. The college is the nugget price, the more significant sum will be taken every bit a margin, and the higher will be the risk for a trade.

You should choose the lot size based on the following factors:

- The volatility of the asset and its assessment method (end loss level).

- The acceptable risk level for all open trades, which each trader determines for themselves.

- Deposit amount.

- Leverage (depending on the calculation method).

How does equity alter depending on the lot size

Equity is the change in the eolith amount during trading. An increment in the lot traded increases the pip value. Remember, the pip value for the EURUSD pair is calculated according to the formula: 0.0001 * 100,000 * merchandise book. The increase in the pip value means an increment in potential turn a profit or loss. With a minimum lot size, the equity changes slowly, gradually. If y'all increase the position volume, the rise, or the collapse in the equity becomes sharper and faster.

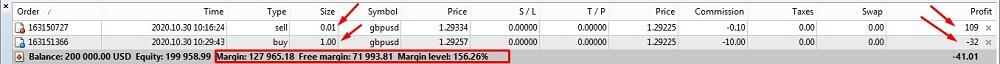

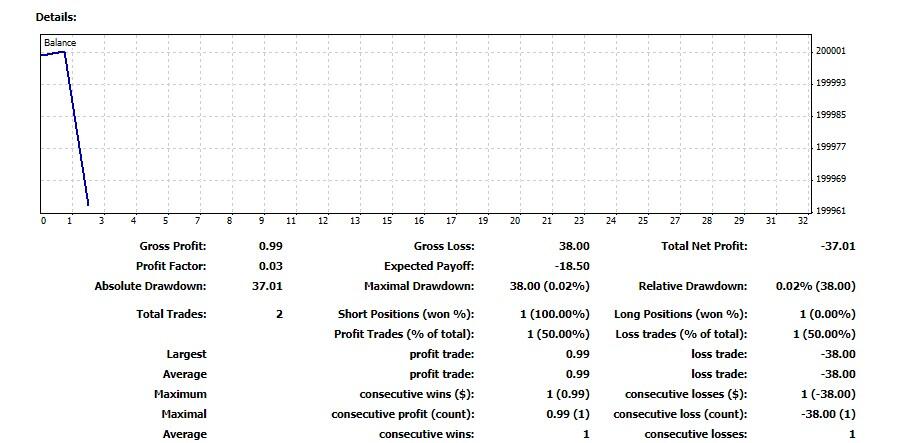

- Example. There is a demo account with a deposit of 200,000 USD and a one:ane leverage. I open two EURUSD positions. One is of 0.01 lot. Some other position is opened a few minutes afterward with a volume of one lot.

The margin is a little more than than thousand USD. There is a pocket-size turn a profit of 1.07 USD (after we deduct the spread) from the first minutes. Side by side, I open the second position of 1 lot.

The Margin (avails used) sharply increases; the Margin Level decreases. All trades could be stopped out as a result of such an unwise strategy. The loss of a few dozens of cents turns into a few dozens of dollars.

I leave the trade. In MT4, I open the Business relationship History tab and correct-click on information technology. I select the option Relieve equally a detailed account.

This is the Residuum change. Subsequently entering the first merchandise of 0.01, I fabricated a small-scale profit. It is the short section of the blueish line in the chart, which is directed up. Side by side, there has been an opposite position of 1.0 lot. The instant loss is shown by a sharp driblet in equity.

How to fix the lot size in MT4

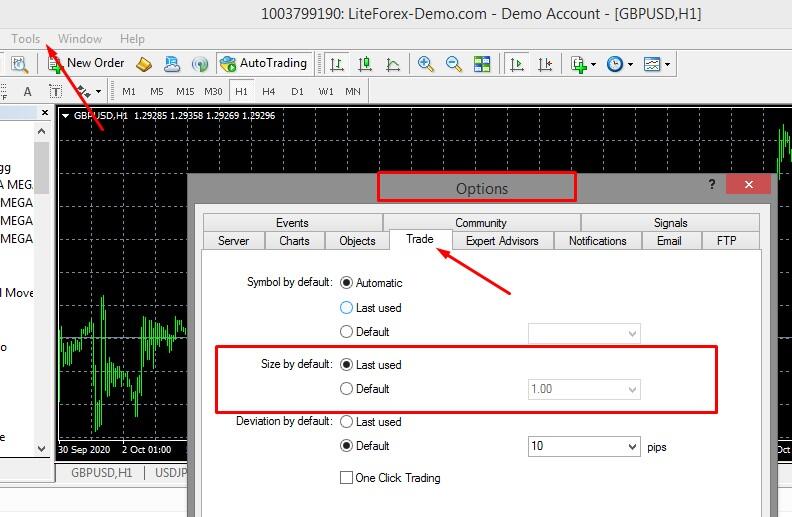

When you open a new order in MT4, the default lot size is 1.0. When it is about split seconds, it is impossible to change the trade book constantly. If you always enter trades with the aforementioned book, you lot can set the position volume as follows: Tools – Trade - Size by default.

In the Good Advisers, the initial lot size is set in the Lots parameter. You can also use the system of automated lot calculation by enabling the UseMoneyManagement parameter. You should specify the run a risk level and the maximum lot size.

What is a lot in other markets?

A lot in any marketplace is a contract. The only departure is in the measurements and quantity of the asset included in 1 lot. For currency pairs, the lot is the number of base of operations currency units, for gold - a troy ounce, for oil — barrels. For stock indices, one lot is the toll of ane share.

1 lot of oil

The adding of a lot size in commodity markets is similar. Yous follow these steps:

Step 1. Open specification to come across the contract size for the musical instrument. You tin can exercise it in the post-obit ways:

- Open up the contract specification on the LiteFinance website via this link.

- Open the contract specification in MT4. First, add the musical instrument into the Market Watch window (View/Symbols/Oil, add UkBrent). Next, find the "Market Picket" icon on the toolbar, correct-click on the UkBrent asset and call the contract specification.

The specification on the LiteFinance website or in MT4 says the contract size is 10.

Step 2. We calculate the amount required to enter a trade of 1 standard lot. The oil cost per barrel is $41. The contract size in the specification ways that 1 lot is equal to ten barrels of oil, which means 41 * 10 = 410. So, you lot will demand 410 USD to open a position of 1 lot.

Note! If you open a position of 1 lot in the LiteFinance last, you volition need 41 USD instead of 410 USD, i.e., the price of one butt.

Reason. In the MT4 specification is a Margin Percentage line; the value is x%. It is unlike for different assets. The margin percent is similar to the leverage, which in this instance is equal to ten%. In other words, when trading using leverage, there is a position opened with a i:10 leverage, which is 10 times less than the lot size.

Important moment: no matter what leverage you set for the account (1: one or one: 100), the position on CFDs on oil, metals,, and stocks will be opened with the leverage written in the specification in the Margin Percentage line. You can read more about margin percentage and forex trading using leverage in the commodity What is Leverage in Trading: Ultimate Guide for Beginners.

1 lot gold

One standard lot XAU is calculated in the same style every bit one lot of oil. The specification states that the size of the contract is 100 troy ounces. If the cost of one ounce of XAUUSD is $1902, then the trader will need 1902 * 100 = $xix,029 to buy one standard lot of gold. Again, we look at the Margin Pct in the specification. The margin pct is 1%, which corresponds to a leverage of 1: 100. This means you can open a position of ane standard lot (100 ounces) at the price of ane ounce.

Note! The margin percent allows you to open a position of a higher volume than your deposit can afford, but the point price is college.

Lot and stock indexes

Brokers accept dissimilar approaches to determining the contract size for the stock CFD. On the LiteFinance trading platform, the size of ane total standard lot for all indices corresponds to one contract. But when you calculate the value of a lot, you need to consider the margin per centum and the currency of the contract, the size and value of the tick.

Example:

The MT4 specification indicates a margin per centum of 1%, which corresponds to a leverage of 1: 100; tick size is 0.i; tick value is 0. The specification on the LiteFinance website reads that the contract currency is GBP; the electric current GBPUSD rate is one.29492. The toll of 1 full standard lot will be: 1.29492 * 5576.2 * 0.i / 100 = seven.22 USD. This will be the amount of the collateral that the broker will block.

How many shares are in a lot

The number of shares in a lot depends on whether you work with an substitution or a banker. In the stock market, one lot size can exist both 1 share and m. LiteFinance has 1 lot equal to one share.

What is a lot in the substitution?

Since the price of shares may be in the corridor from a few cents to thousands of U.s.a. dollars, the arroyo to the lot'south terminology is different hither. In most cases, NYSE and NASDAQ set up the value as "1 lot = 100 shares", and it is almost impossible to buy a fraction of a lot.

It is easier to invest through a Forex broker. Trading with a broker, you can also invest in securities of the world's leading companies and stock indices. At that place are a number of advantages in comparison with stock investing:

- Smaller contract sizes. For individual securities, the size of a standard lot is equal to one share. A pocket-sized deposit is enough to open a deal, while on the stock commutation, the minimum merchandise volume tin can be from USD i,000 and more.

- Greater leverage.

- Yous tin can open short positions.

- You can't purchase a lot of less than 1 share on the substitution. A broker allows trading stock CFDs so that you can split a lot.

You tin can endeavor the functions of the brokerage trading platform gratis here. After the registration that takes a couple of minutes, you tin can open up a demo account and enter trades on whatever instruments. Endeavor, it is like shooting fish in a barrel and exciting!

Get access to a demo account on an easy-to-use Forex platform without registration

Get to Demo Account

Decision

Assessing the risk level and computing the maximum allowable lot book is one of the gamble management system'south foundations. Deviations are acceptable. In volatile markets, it makes sense to lower the chance level for each new trade, merely at the same time, increment the length of the stop loss. On the contrary, in trend markets, it makes sense to put short stop signals and use the method of increasing the position. Before you start trading, you should calculate the minimum, average and maximum length of stop loss in the historical period (separately for each instrument). You can prepare a model that will allow you to speedily change the input information and accommodate the trade book in case of changing marketplace conditions. If you have questions, please ask them in the comments. Good luck in your trading!

FAQ

Follow general rules of risk direction:

- The trade volume should non be more 2%-5% per centum of the deposit amount. It is about the amount of money that is blocked by the banker equally collateral.

- The total risk should non exceed ten-15% of the deposit. The risk ways the maximum possible loss. It depends on the size of the stop loss and the pip value. For case, with a $100 deposit and a $1 pip value, the maximum stop length is 10-fifteen pips.

- Assess the level of the current volatility in comparison with the average value. At times of increased volatility, reduce the volume of transactions.

- Focus on the trading strategy type and the adventure of the roundup forecast mistake.

Go through the following steps:

1. See the contract size in the specification.

ii.Calculate the lot size according to the following formula:

- For indirect quotes and CFDs: contract size * base currency price.

- For straight quotes: the lot is equal to the size of the contract.

- For cantankerous rates: contract size * asset cost / quoted currency price to USD.

The currency trading lot calculation formulas do not consider the leverage and the margin size, which reduce the actual lot value when you enter a trade.

The number of base units in 1 full lot depends on the lot type:

- Standard lot - 100,000 base units.

- Mini lot - 10,000 base units.

- Micro lot - 1,000 base units.

- Nano lot - 100 base units.

For instance, If the EURUSD exchange rate is 1.2, ane full micro lot volition be yard EUR, for which you will need one 200 USD. Accordingly, ane whole nano lot will exist 100 EUR, 1 whole standard lot is 100,000 EUR.

Example of the value of ane standard lot in Forex

- 1 lot EURUSD = 100 000 EUR

- i lot USDJPY = 100 000 USD

- 1 lot NZDCAD = 100 000 NZD

It ways that you enter a trade with the volume twice every bit much as 1 lot.

For example:

NZDCAD micro lot. 1 micro lot ways a trade book of one thousand NZD. When entering a long trade of ane lot, you lot buy one thousand NZD. two micro lots: the trade volume is 2000 NZD.

EURUSD standard lot. one lot ways a merchandise with a volume of 100,000 EUR. When you open up a long position, you purchase 100 000 EUR. The position volume of two lots means you buy 200,000 EUR.

Brent/USD standard lot. 1 lot ways a trade of 10 barrels, two lots means 20 barrels.

It depends on the asset value, leverage, and risk direction strategy. For example:

- FTSE Index. The price of i lot is 7.two USD. If the run a risk per trade is 5%, it is allowed to open up a position of 10 USD. Therefore, the permissible transaction volume is 1 standard lot (in indices, lot splitting is non allowed)

- UKBrent. The cost of 0.one lot is $ three.71 for 37.xi per barrel. You lot tin open up a trade with a volume of 0.3 lots for $ 11.fifteen.

- EURUSD. With a leverage of ane: 100, the cost of a 0.01 standard lot would be just over $ eleven. This is the optimal lot size.

- XAGUSD. The price of a minimum lot size of 0.01 is 11.six USD. This is nigh in line with the risk management policy.

There tin't exist the best or the worst lot size in Forex. The appropriate lot size depends on:

- Deposit amount.

- Risk management rules and the commanded level of risk.

- Trading conditions for the account (a standard lot, mini, micro lot, cent accounts).

- Turn a profit targets. The larger the lot size, the greater the potential turn a profit. Nevertheless, the pip value will increase in this instance, and then, the greater volition be the level of take chances.

- Trading instrument and conditions written in the contract specification.

The optimal transaction book too depends on the market situation: volatility, primal factors. What is the best lot size in Forex? You tin can only determine yourself.

This is the volume of the asset that you purchase/sell for the currency of the deposit. For example:

- 1 standard lot of GBPUSD at the rate of 1.3056 means that you buy 100,000 GBP (GBP is the base currency) for 130,560 USD. Or when you sell 1 lot, y'all become the respective amount in USD.

- 1 GBP USD mini lot at the rate of i.3056 means that y'all purchase 10,000 GBP for xiii,056 USD.

- 1 standard lot for Brent/USD at $ 41per butt means buying 10 barrels of oil for $ 410.

- 1 standard lot for XAUUSD for $ 1902 per ounce means yous purchase 100 ounces for $190,200.

The broker'due south trading conditions make up one's mind the minimum and the maximum trade volume in lotsn notice them out in the offering, trading account conditions,, or specification in MT4. For example, for currency pairs, the minimum lot is 0.01, the maximum is 100. For oil CFDs, the minimum lot is 0.1, and the maximum is 5. Check the minimum and maximum lot values for a particular instrument from the broker's support service or trading platform.

The value of ane lot depends on ii parameters: the type of lot and the underlying asset. For instance, in currencies, 1 standard lot is equal to 100,000 base of operations currency units, ane mini-lot is 10,000 units, and a micro-lot is 1,000 units.

Under LiteFinance trading conditions in terms of financial assets, one standard lot is equal to:

- Currencies - 100,000 units.

- Oil - x barrels.

- Gilded - 100 troy ounces.

- Argent - 5000 troy ounces.

A mini lot is 0.1 of a standard lot. For instance, if a trade of i lot of Brent crude oil is ten barrels, and so 1 micro lot corresponds to trade of i barrel. 0.1 mini lot is equal to 0.01 standard lot or 1 micro lot.

A micro lot is 0.01 standard lots or 0.ane mini lots. For example, if the EURUSD change rate is 1.12, a standard lot will be 100,000 base of operations units, a micro lot is ane,000 base units. A trade with a book of 1 micro lot means that it will take $ 1,300 to buy thou EUR.

P.S. Did you similar my article? Share information technology in social networks: it will be the best "cheers" :)

Enquire me questions and comment below. I'll exist glad to answer your questions and requite necessary explanations.

Useful links:

- I recommend trying to trade with a reliable broker here. The organization allows yous to trade by yourself or copy successful traders from all across the earth.

- Use my promo-code Blog for getting deposit bonus 50% on LiteFinance platform. Only enter this lawmaking in the appropriate field while depositing your trading account.

- Telegram chat for traders: https://t.me/liteforexengchat. We are sharing the signals and trading experience

- Telegram aqueduct with high-quality analytics, Forex reviews, training manufactures, and other useful things for traders https://t.me/liteforex

Price chart of EURUSD in real fourth dimension mode

The content of this article reflects the writer'due south opinion and does non necessarily reflect the official position of LiteFinance. The material published on this folio is provided for informational purposes only and should not be considered as the provision of investment advice for the purposes of Directive 2004/39/EC.

What Does Units Mean In Forex,

Source: https://www.litefinance.com/blog/for-beginners/how-to-calculate-a-lot-on-forex/

Posted by: racelowitood.blogspot.com

0 Response to "What Does Units Mean In Forex"

Post a Comment